It's a reflection of production level and sell-through.

#Cogs cost of goods sold full

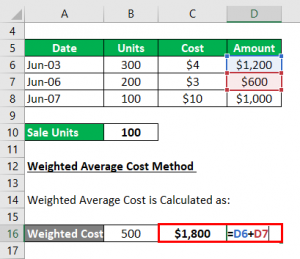

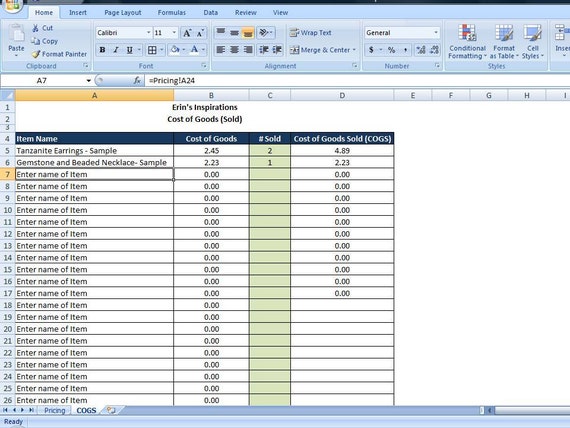

Not everyone wants to reduce their prices if their customers are happily paying full price for products, but reducing your prices with COGS in mind is a great way to grow your customer base while still being profitable. The calculation for gross profit is revenue - COGS:įor example, Caraway, one of our customers, optimized pricing during a product launch due to high COGS. Using your COGS figure, you can then calculate your gross profit. With that said, the COGS in 2022 can be calculated with the following formula: Throughout 2022, the brand purchases $15 million in additional inventory and fails to sell $10 million in inventory. Let's assume a consumer product brand starts 2022 with $30 million in beginning inventory (the ending inventory balance from 2021). Some are variable costs like labor and storage costs, while others are fixed costs like insurance and utility bills.Įxamples of costs generally used in COGS include: What Is Included in Cost of Goods Sold?ĬOGS includes all the direct costs incurred by a company when it manufactures products. Important note: You can use the formulas to calculate your cost of goods sold, for your entire inventory, a product line, a SKU, or any other inventory breakdown. End inventory value is the total potential revenue of the inventory that wasn’t sold during in the period.Then, subtract your end inventory value from cost of goods available, and you’re left with cost of goods sold. Cost of goods purchased and/or cost of goods manufactured: cost of items bought or produced during the current period.Initial inventory value: the total potential revenue (excluding discounts) of your inventory that has rolled over from the previous time period (previous month/year/etc.).

#Cogs cost of goods sold how to

How To Calculate COGSĬost of goods sold can be calculated in a number of ways, but we recommend using a two-part formula.įirst, from a given time period, calculate your cost of goods available by subtracting COGP (cost of goods purchased) and/or COGM (cost of goods manufactured) from your initial inventory value. What Is Cost of Goods Sold (COGS)?Ĭost of Goods Sold (COGS, i.e., the cost of sales) refers to the direct costs incurred by a company while manufacturing and selling its products. Understanding COGS and optimizing it can mean the difference between scaling a business profitably and running a short-lived business. In the case of Cost of Goods Sold (COGS), though, we’re talking about a must-track metric.ĬOGS consists of all of the direct costs involved in manufacturing and selling products–which ultimately affect profits.

There are dozens of metrics you can track to measure the health and success of your business, and it’s overwhelming to understand the differences between the “nice-to-track” metrics vs.

0 kommentar(er)

0 kommentar(er)